His conclusion is extremely wrongheaded and highly revealing. His last paragraph reads:

A growing economy and lower unemployment should eventually give U.S. workers a long-deserved raise (and so should rising labor costs overseas that persuade more companies to hire domestically). But improvements in technology and the ability of companies to hire locally as they chase worldwide demand are just two factors that should restrain any optimism we can keep corporate profits from gobbling up more and more of the economy. Workers still need help -- and they certainly won't find it in the sequester.When the Republicans rail against "the culture of dependency", this can serve as one of the most prominent examples. And the author doesn't even realize that he himself is living in dependency. He writes about the extraordinary growth of corporate profits and bemoans the lack of wage growth during the same period. Does he offer any solution? No. He hopes, vainly, that companies flush with profits will pass it along to their workers.

This is the problem with perception that many "skill" workers have with the companies that employ them. They think that because the company they work at treats them well and gives them a good wage, that companies everywhere should do the same for every worker. But the reality is that companies only treat their employees as good as they need to. And when an opportunity exists for cutting costs, shedding dead weight, or shuttering entire divisions, you can bet that management will take it.

The reason why companies like Google pays its employees so well is because the employees they hire are extraordinarily talented. Their software developers are treated like rock stars because there aren't many talented developers in the labor market and Google is a company whose profits and reputation rest upon the utility of their software. Media companies like the Atlantic Media Company pay its writers well because they want good, reliable writers that are hard working and relatively sophisticated wordsmiths. Those too, surprisingly, are in short supply.

When times are good and profits are high, companies expand their payrolls and efficiency gets relaxed upon the altar of inertia: "who cares? Our stock is still soaring". But when times are hard, the McKinsey and Bain consultants come in, tell the corporate leadership that 20% of their employees are unnecessary, dead weight, or even counterproductive, and then payrolls get slashed until the company gets lean.

If you're fired or laid off, and if you don't have any (currently) relevant skills, the next job you get will pay substantially less than your former position. And when that happens, and people realize their emergency fund barely covers 1 month worth of expenses and start dipping into whatever meager savings they have (or start raiding their 401ks in a disastrously short sighted way to keep afloat), reality hits them hard. They had things going so well for so long that they assumed it would continue in perpetuity (or at least until they made the decision to voluntarily retire).

Our country has a spending problem. People spent too much money when times are good and never saved any of it. And once things turned bad and stayed bad, everybody realized that their situation was far more precarious than they ever thought. Collectively, we are far too dependent on our jobs. It remains most people's only source of income. It defines people at a personal level (I am a software developer, not a person who just happens to develop software). And the fact is it can be taken away by a company so very easily.

That kind of dependency is horrifying. Because you aren't depending on your friends or family. You're depending your very livelihood on an entity that, at the end of the day, only has eyes on the bottom line. That is sheer lunacy.

What so many people forget is that nobody deserves a well paying job. Your compensation is tied directly to how valuable you are to somebody else. And when disruptive technologies or market conditions suddenly make your labor less valuable to somebody else, you get laid off. So what were you doing during the good times? Saving money?

Hah! Yeah right. Like most Americans, you were taking out home equity loans to pay for kitchen and bath renovations or paying for new cars even when your 6 year old car was still perfectly serviceable for an additional 5+ years.

|

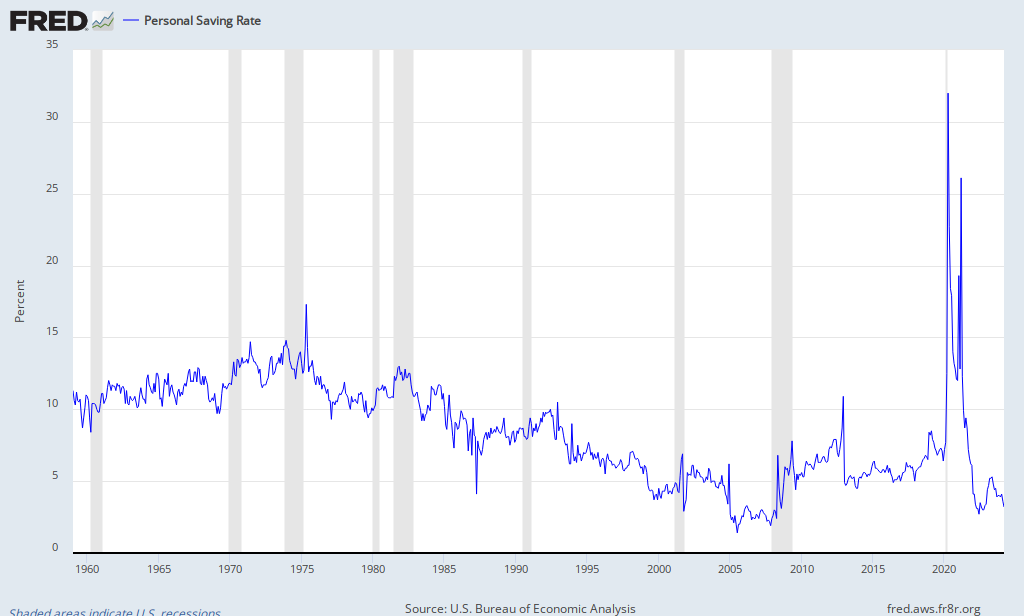

| Our country's relative decline, summarized in one handy-dandy chart. |

That is my actual net worth (courtesy of Mint.com)

at the time of this blog post. I'm 26 days from turning 25 years old. I

save and invest about 15% of my after-tax pay in my taxable brokerage

account. My 401k account gets a pre-tax 13% contribution (including the

company match). Another 8% after-tax goes into my Roth IRA. And every

month, I reduce the principal on my mortgage by 500 dollars. Almost half

of my take home pay is dedicated towards increasing my net

worth. And even then, I know that if I were to lose my job tomorrow, I

would still be in a terrible financial position.

I need about 10 more years of doing what I'm currently doing (employed at a career-track job, saving as I currently am) before I can realistically have the slightest modicum of financial independence. Because even though I am so much better off than the vast majority of 25 years old, it's still nowhere close to safety, or even relative comfort. My situation is only slightly less precarious than the average 25 year old American.

But if I continue to be lucky, and to be honest with myself, I can gain relative financial independence in about 15 years. Otherwise, I'll be just like any other American out there. One firing, downsizing, or injury away from a personal financial death spiral.

That is the kind of dependency that the vast majority of Americans find themselves in without even realizing it. If you asked a 25 year old what their idea of independence is, it's a job that allows them to pay for a cell phone and wireless plan, an apartment lease, a used car, food and groceries, and beer. A 35 year old's idea of independence isn't too far removed from that either.

So let's go back to Derek Thompson's blog post. He complains that corporate profits are too far removed from GDP and wage growth. My advice? Buy corporate equity and get some of those record profits for yourself. The barriers to retail investing have never been lower than they are now. Are you complaining about corporate profits? Guess what? You can buy a share of it. Open an account at Fidelity and deposit just 2.5k into a Roth IRA. You can buy 16 shares of an S&P 500 index fund (I recommend either IVV or SPY) commission free. You can use your tax return refund for it instead of buying that new flat screen TV and couch you had your eye on.

The majority of Americans are fortunate enough to be able to work their way into financial independence. There is only the culture of dependence holding them back.

I look at U.S. aggregate savings level and I see two things:

ReplyDelete1) stagnation of long term secular growth, aka the great stagnation

2) a global savings glut pushing down U.S. equilibrium interest rates beginning in the late 90's after the asian crisis

Because the U.S. dollar is the reserve currency, the most "money" of all the monies, emerging markets and petro-states began flooding the market with demand for AAA rated dollar denominated assets. This increased people's net worth and depressed real interest rates close to zero.

Now there's two ways we can respond to a global increase in desired savings so that savings = investment:

1) Allow incomes and AD to fall so that less savings exist (a recession)or...

2) Let savers bid up asset prices which will increase consumption, which is what I think is exactly what happened to the U.S.

Technically, this should be fine. Only by sheer fluke would every country's desired savings and desired borrowings perfectly match. But the huge increase in global savings pushed rates so low that when U.S. consumers began increasing their desired savings in 2008 real rates fell to negative, pushing us up against the zero lower bound. So now we're being forced through the scenario: a recession.

Now I think theres a few ways we can escape without going through a recession blah blah blah, but my point is I don't think the moral story you're trying to weave adds up. I know this fits in well with the GOP narrative, but economics is not a morality play, and I think telling stories framed in that way is potentially very damaging and misleading.

"increasing their desired savings in 2008 real rates fell to negative"

ReplyDeleteSorry. Replace "real rates" with "the natural rate" here. The natural rate is the rate at which the loan-able funds market clears and planned savings = planned investment. If that rate is negative, and the federal reserve is targeting a zero rate, then the market will not clear, and we'll enter a recession.

In my mind I see the increasing pool of corporate cash as a result of this this market not clearing. Above the zero bound the central bank adjusts the real interest rate to match the natural rate so that a deferment of consumption to the future by consumers (savings) will be matched by an increase in spending on capital goods (investment), allowing firms to produce more consumer goods in the future to match the expected future demand.