Sorry for the late counterpoints. Usually I like to have them up right after the show or the following morning, but I just couldn't get around to it. Anyways, let's get to it.

1. Defense cuts: In the show, Maher goes on his usual rant against defense spending. And the reason why he can get away with it is because of two unavoidable truths:

- The US spends more on defense than the next 10 countries combined

- There is extraordinary waste in the defense budget

Personally, I'm torn on the subject. There is growing evidence that, given the current structure of the budget, there is not enough money to replace/maintain our aging fleet of aircraft and naval vessels. But we are also the most powerful military in the world, and the only country with armed forces capable of deploying overwhelming force anywhere in the world (with the possible exception of the UK).

Force projection is our military's sine qua non. Following that is the exceptional training, readiness, and experience of our combat personnel. All of that costs money to build and maintain. And building from scratch is much more expensive than providing for the current state of affairs. While there is extraordinary waste in the budget, a lot of that comes from the appropriations process that Congress loves to manipulate. Every Congressman has to get their own piece of the defense pie, and that means a bloated procurement process.

And there is also the legitimate quandary that other countries could soon decide to spend more on defense if they perceive the US to retrench from its commitments. History has shown that the periods of greatest conflict occur when the dominant power shows increasing signs of weakness, which emboldens upstart powers to challenge that status.

2. Giving the crazy a voice: In the show, Maher referenced some stupid Glenn Beck idea and an outrageous comment from a now-obscure former Republican official and wanted the panel to condemn the ideas. But instead, the panel called him out on hit, saying that these sorts of people are instigators who want to create controversy in an attempt to draw attention to themselves.

I'm glad that the panel called him out on it because all too often, the right-wing publicity whores (Beck, Limbaugh, Coulter, etc) are trotted out by the Democratic leaning media as examples of the extremism and ridiculousness of the Republican Party. Because the intelligent and well informed Republicans (if you rolled your eyes after those words, you're part of the problem) don't confirm the media's preconceived ideas of stupid Republicans, they are much more obscure and their ideas and statements don't get the same kind of coverage.

There's a lot less separation between the actions of the Democratic Party and the Republican Party than people think there are. But because we attach so much importance to symbolism and speech, we use that as an excuse to create wedges between various portions of the electorate.

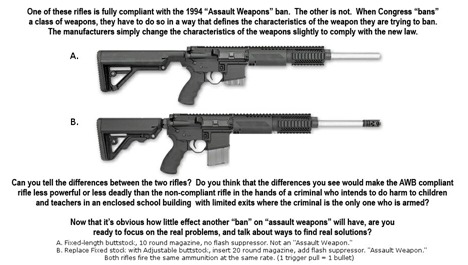

3. Boiling frogs - gun control edition: What Martin Short advocated on the show, incremental gun legislation with the aim for the near-eradication of universal individual firearm ownership, is the goal of many self described progressives and "hardcore" Democrats.

This is modus operandi of every non-democratic politico out there: we know that our end goals are impossible to implement if presented wholesale to the public, but surreptitious and incremental advances can achieve our end goals over the course of time.

If I had to describe progressivism in one sentence, it would be this: the advocacy of ideas which are currently anathema to the majority of people that will eventually become acceptable/desired in the future. In this case, the progressives are the agents of history. And they get to be the "good guys" whereas those that obstruct the march of progress (Strom Thurmond is probably the poster boy for this archetype) are condemned to infamy in the history textbooks.

It's the fantasy of just about every serious Democratic politico out there. Bill Clinton, who knows how to rile up a crowd, famously said in 2008:

It didn’t work in 1992, because we were on the right side of history. And it won’t work in 2008, because Barack Obama is on the right side of history.

It is this obsession with being on the right side of history that keeps the progressives going. And the numerous reality checks they get in the present don't deter them, because they know, in their hearts, that this too shall pass. And their goals will be realized in time, and then it's on to the next cause.

That is the kind of self satisfaction is what drives certain Republicans (and me, although I am NOT a Republican) crazy. Because it is true, the endgame for Republicans and Democrats are different. For Republicans, it's the continued dominance, now and forever, of the United States. For Democrats, it's about an egalitarian society in which everybody is entitled to a "comfortable" standard of living and has near-unlimited individual freedoms in the social sphere.

There is obvious friction between those two ideologies. And Democrats are mad that most Americans subscribe to the former (hence their endless, obviously frustrated, proclamations that "the US is still a center-right country"). But, according to their ideology, that too, shall pass.

4. Rula Jebreal is crazy attractive, and crazy annoying: In my mind, Rula Jebreal is the prototypical progressive. She is forthrightly self-righteous and loves to champion the cause of the underdogs. Progressive climate change policy and Palestine are the two perennial losers of the political world, and thus the most endearing to progressives. But it's the way she carries herself about these issues that makes her grating.

When Bill Maher moved on to the Manti Te'o controversy, she interjected something to the effect of "why are using your show, an incredible political platform, to talk about trivial bullshit?" And that was when I realized that, although it is the politically correct stance to acknowledge that the controversy is trivial in the Grand Scheme of Things™, she's being a self righteous prick. It behooves me to quote Adam Smith:

Be assured, my young friend, that there is a great deal of ruin in a nation.

Change that to "the world" and you get my meaning. This is a planet of 7 billion people. There will always be a ton of tragedies, unfortunate circumstances, and general unpleasantness. It's simply unavoidable. And now it's time to quote

House:

If we were to care about every person suffering on this planet, life would shut down.

Sorry, but sometimes having an endless parade of bad things brought to our attention puts us in a bad mood. Why are you, Rula Jebreal, wearing makeup when you could have used that money to donate to starving kids in Africa? Why are you, Rula Jebreal, wearing expensive looking clothes when you could have used that money to give antibiotics to poor people in Indochina?

So fuck you, Rula Jebreal, in your self righteous asshole. You may be able to get away with it because you're ridiculously hot, but trust me, if you weren't, you'd be ostracized until you finally figured out that we simply don't have the capacity to use our undivided attention to care about every single bad thing that goes on in the world.

5. Michelle Caruso-Cabrera got cheated on: You can just tell in the way that she said "he's lying. He's lying. He's lying" as if she felt compelled to say it three times in a row.